Why You Must Consider an Offshore Trust Fund for Shielding Your Assets and Future Generations

If you're aiming to protect your riches and guarantee it lasts for future generations, thinking about an overseas depend on could be a smart step. These trusts provide one-of-a-kind benefits, such as enhanced asset security and tax effectiveness, while also keeping your privacy. As you explore the potential of offshore counts on, you'll find how they can be customized to fit your details requirements and goals. What exactly makes them so appealing?

Understanding Offshore Depends On: What They Are and Just How They Work

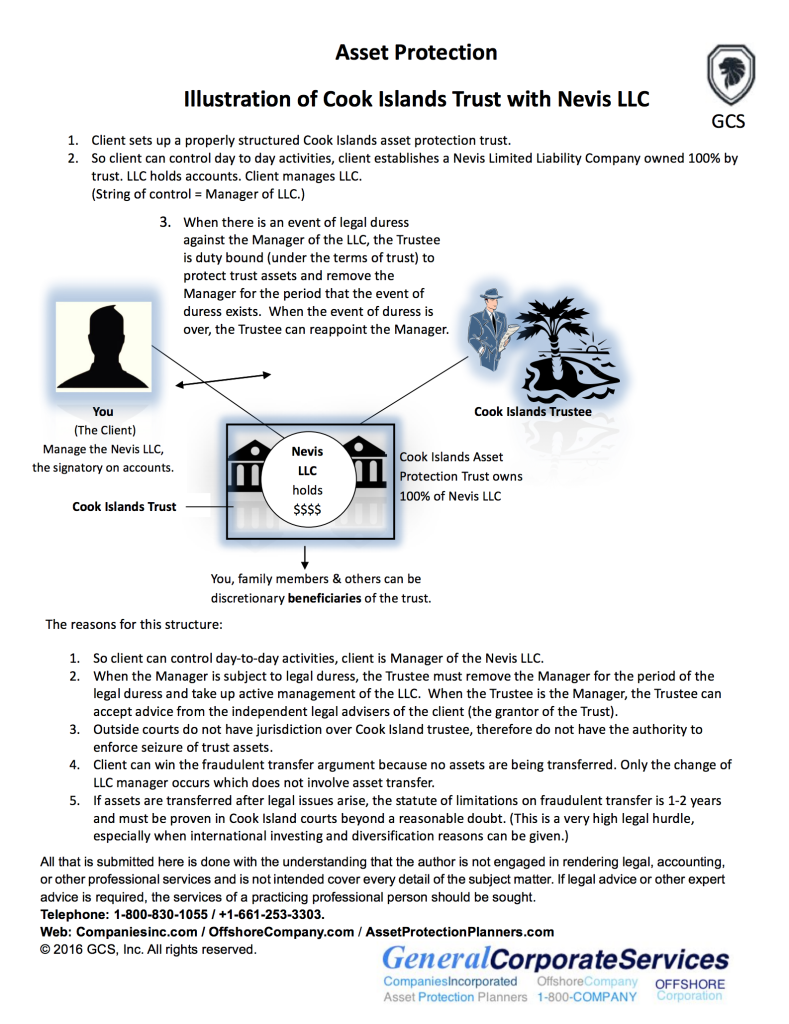

When you assume concerning protecting your properties, offshore trusts might come to mind as a feasible option. An overseas count on is a lawful plan where you transfer your possessions to a trustee located in another country.

The trick elements of an offshore trust consist of the settlor (you), the trustee, and the recipients. You can customize the trust to your demands, defining exactly how and when the possessions are dispersed. Considering that these trust funds frequently operate under positive regulations in their territories, they can offer boosted privacy and protection for your wealth. Recognizing exactly how offshore depends on function is important before you choose whether they're the ideal selection for your asset defense technique.

Benefits of Establishing an Offshore Trust Fund

Why should you take into consideration establishing an offshore count on? Among the main benefits is tax effectiveness. By positioning your properties in a jurisdiction with beneficial tax regulations, you can possibly reduce your tax problem while guaranteeing your riches expands. In addition, overseas counts on provide flexibility pertaining to possession management. You can customize the count on to satisfy your particular demands, whether that's preserving control over your possessions or ensuring they're dispersed according to your desires.

An additional secret advantage is personal privacy. Offshore counts on can offer a higher degree of privacy, securing your financial events from public scrutiny. This can be vital for those desiring to keep their riches discreet. Developing an overseas trust fund can advertise generational wide range preservation. It allows you to establish terms for how your properties are dispersed, ensuring they benefit your future generations. Eventually, an offshore trust can offer as a tactical tool for safeguarding your economic heritage.

Shielding Your Possessions From Legal Cases and Lenders

Establishing an offshore count on not only offers tax obligation benefits and personal privacy yet additionally offers as a powerful shield against lawful claims and creditors. When you position your possessions in an offshore trust, they're no much longer thought about part of your individual estate, making it a lot harder for creditors to access them. This splitting up can protect your wealth from lawsuits and cases arising from company disputes or personal liabilities.

With the appropriate territory, your possessions can benefit from rigid privacy regulations that hinder lenders from pursuing your wealth. In addition, several overseas counts on are designed to be testing to permeate, typically needing court activity in the count on's jurisdiction, which can function as a deterrent.

Tax Effectiveness: Lessening Tax Obligations With Offshore Trusts

In addition, given that counts on are commonly exhausted in a different way than individuals, you can take advantage of lower tax obligation rates. It's necessary, nonetheless, to structure your depend on properly to guarantee compliance with both residential and international tax laws. Collaborating with a certified tax obligation advisor can assist you navigate these complexities.

Ensuring Personal Privacy and Discretion for Your Wealth

When it pertains to securing your wealth, guaranteeing personal privacy and privacy is important in today's increasingly clear monetary landscape. pop over to this site An offshore trust can supply a layer of protection that's tough to attain via domestic options. By placing your properties in an overseas jurisdiction, you secure your economic information from public analysis and decrease the danger of unwanted focus.

These trust funds commonly include strict personal privacy regulations that stop unauthorized access to Recommended Reading your financial information. This means you can secure your riches while preserving your satisfaction. You'll additionally limit the possibility of lawful conflicts, as the details of your trust remain private.

Moreover, having an overseas trust indicates your possessions are less at risk to individual liability claims or unexpected monetary situations. It's a proactive step you can take to assure your monetary legacy remains undamaged and private for future generations. Count on an overseas structure to guard your riches properly.

Control Over Possession Distribution and Management

Control over property distribution and administration is just one of the vital benefits of establishing an overseas trust fund. By developing this count on, you can determine how and when your properties are dispersed to beneficiaries. You're not simply turning over your riches; you're establishing terms that show your vision for your tradition.

You can establish specific conditions for distributions, assuring that recipients meet certain requirements prior to receiving their share. This control helps prevent mismanagement and guarantees your properties are used in means you regard proper.

Additionally, designating a trustee enables you to hand over administration obligations while keeping oversight. You can choose someone article who lines up with your values and comprehends your objectives, guaranteeing your assets are taken care of sensibly.

With an offshore trust, you're not only safeguarding your wide range but also shaping the future of your recipients, supplying them with the assistance they need while keeping your preferred level of control.

Picking the Right Jurisdiction for Your Offshore Count On

Try to find countries with solid legal structures that support count on laws, making certain that your possessions continue to be protected from prospective future cases. Furthermore, access to regional economic organizations and seasoned trustees can make a large distinction in handling your count on efficiently.

It's necessary to assess the prices involved also; some territories may have higher arrangement or upkeep costs. Inevitably, choosing the best territory means straightening your monetary objectives and household requires with the details advantages supplied by that location - Offshore Trusts. Take your time to study and consult with experts to make the most enlightened decision

Often Asked Inquiries

What Are the Expenses Related To Setting up an Offshore Trust Fund?

Establishing an offshore depend on involves numerous prices, consisting of legal costs, arrangement costs, and ongoing upkeep costs. You'll wish to allocate these variables to ensure your count on operates successfully and properly.

Just How Can I Discover a Respectable Offshore Trust Service Provider?

To discover a reputable overseas depend on supplier, research online reviews, request references, and validate qualifications. See to it they're skilled and transparent regarding costs, solutions, and guidelines. Depend on your reactions throughout the selection process.

Can I Handle My Offshore Trust Remotely?

Yes, you can manage your offshore trust remotely. Many companies provide on-line gain access to, enabling you to keep an eye on investments, communicate with trustees, and gain access to records from anywhere. Simply assure you have secure web accessibility to secure your info.

What Occurs if I Relocate To a Different Country?

If you relocate to a various nation, your overseas trust's laws could transform. You'll require to speak with your trustee and possibly change your depend on's terms to follow neighborhood laws and tax obligation ramifications.

Are Offshore Trusts Legal for People of All Countries?

Yes, offshore trusts are lawful for citizens of several countries, yet policies vary. It's important to investigate your nation's laws and speak with a legal expert to guarantee compliance and understand prospective tax obligation effects before proceeding.